Dividend options: the equity investor’s shiny new toy

Dear frustrated portfolio manager,

Are you fed up of playing second fiddle to that star trader whose P&L is that bit more consistent? Is your client base growing weary of those cookie-cutter strategy PDFs you send them every month?

Perhaps you’re just bored of the identikit portfolio you’ve been presiding over for what feels like too long.

Well, there is an exciting new asset class that might be able to soothe some of that angst. It’s liquid. It’s exchange-traded. And it’s NOT volatility. I speak of dividends – the best dealing desk-recycled product since… never mind.

What are dividends, you ask? For our very specific purposes, dividends are a derivative product which returns an amount based on the aggregate dividend income paid in a year by a company, or the companies in an index.

Eurex’s futures on the dividends of the Euro Stoxx 50 constituents are now highly liquid – and since June last year, options have also been available.

In September, this column examined some of the pitfalls in dividend futures: the market’s seasonality, one-sidedness, and consequent vulnerability to sudden crashes. But such volatility is also a hunting ground for the savvy investor.

Without wishing to exaggerate, dividends are like zero coupon bonds on ecstasy.

How so? Both begin life at a discount to par. The lingo is interchangeable – practitioners in both fields speak of the “pull to par”, “trading strips” and the “stickiness of value”.

Both have a generally low beta, save for scary periodic dislocations in value. And it’s no coincidence that the options of both assets are priced using the Black-76 model.

Why are dividends more exciting? With a ZCB, par value is always 100, but dividends have no such cap on returns. It very much depends on the alpha in the trade. But I’m getting ahead of myself.

Having canvassed some of the great, the good and the well-intentioned of the dividend world I can share with you five trading ideas, hot from the fevered brains of investment bankers eager to dish out these products.

These ideas, which range from the simple to the speculative, incorporate dividend futures, options and in some places, both. As an extra treat I’ve even done your due diligence for you. Memorise the lines from the three boxes to fool that vexing compliance officer into believing that you’ve grown a sense of empathy.

No 5. Beta: Buy and hold

The entry level trade is simply to buy and hold. Salesmen are using two recurrent narratives to convert long-only investors to trade dividends:

Inflation Morgan Stanley, among others, is beating this drum. The argument is that dividend yield growth tends to exceed inflation. Therefore dividends, like gold, are an asset class investors may reach for in inflationary environments.

There’s a flaw, or rather a 5% ceiling, in this argument that I raise in idea No 4.

Diversification Dividends are liquid, have a risk-return profile of their own and are easy to understand. For those reasons some say they are a good diversifier for asset managers. Anecdotal evidence suggests that pension funds are among the long-only beta investors in dividends.

|

Due diligence: The three to six year bucket As I have previously described in these pages (see FOW September 2010), structured product flow can hit dividend derivatives hard. This is what happened after the May 6 Flash Crash, which triggered lots of dividend trade unwinds by structured products issuers. The effect was to create a wave of selling in the listed market, which depressed dividend futures prices for months. The three to six year contracts are particularly vulnerable. Deutsche Bank warns: “If structured products issuance picks up there may be an oversupply of dividends in the market… That’s one reason why for risk-averse investors we prefer shorter dated contracts, where fundamentals rather than technicals are more of a driver of performance.” By “supply”, the bank means interest in receiving cash and paying the outcome of the dividend calculation. |

No 4. Alpha: Discretionary trading

Some say dividends are a value investment that’s going cheap. This was ex-SocGen analyst James Montier’s rationale when he first tipped them in 2008. The one-sidedness of the market made it so. Because all the structured products issuers wanted to sell dividend risk, you could buy it cheap.

Three years later, that argument is not so compelling. Stuart Heath, head of Eurex’s London office, says growing liquidity has tightened up some of that dislocation in value: “The growth in popularity means dividends are now more or less a two way market. That pricing anomaly is not as apparent as it was just 12 months ago.”

To put some numbers to that statement, I spoke with Pamela Finelli, managing director of equity derivatives strategy at Deutsche Bank in London: “

“Dividends are still underpriced but now the case for value is a debate rather than an objective statement. A bearish analyst may not believe the dividend discount is actually 12%, and investors may not think the current discount is worth pursuing, given the historical dislocation. We remain positive on the December 2012 contract and still see an attractive risk/reward at current levels.”

When should the alpha-seeking investor trade? There are two rules of thumb:

Seasonality The annual index contract feels a “pull to par” during the year of expiry. Take the December 2011 contract. Eighty percent of this year’s dividends for the Euro Stoxx 50 companies were announced in February and March. There’s a bit more relevant news flow in July and then some more in October.

This tendency to converge with an expected value is the “stickiness in value” one associates with a zero coupon bond.

Hence, unless there is a major crash, December 2011 is now more or less a dead trade, from a capital appreciation perspective – the value is priced in.

Value investors should look to 2012 and beyond, where the discount in value is still apparent.

The range According to a delta one analyst I spoke to, the aggregate dividend yield for the Euro Stoxx 50 rarely strays outside a range of 2.5% to 5%.

“If you divide the value of the active future (December 2012), 123, by the current index level, 2,847, you get 4.3%. That’s near the top of the range. So to argue that the future is 12% undervalued, or thereabouts, is contentious.”

“A range – sounds like the perfect dynamic for a call spread,” I suggested.

“You’re not the first person to notice that,” he replied.

Next year’s futures are near the top of the valuation band. The December 2013, trading at 116, or 4%, is some 30bp cheaper using the range model.

Call spreads, particularly on contracts like December 2012, which are near the top of the range, seem to be popular with traders.

|

Due diligence: Share buybacks Read up on the “dividend substitution effect”. Companies have many options when it comes to rewarding shareholders and keeping up appearances. A firm whose share price is falling might window-dress its earnings a share rather than raise its dividend. So be careful with your assumptions. Simply identifying companies flush with cash does not necessarily indicate forthcoming dividend growth. The yield, inflated in times of share price deterioration, is as much an indication as dividends per share. |

No 3. Overwriting: The dividend sandwich

This strategy was much discussed at FOW’s European Equity Options Trading Conference in April. It’s quite simple to execute.

First, buy a future on the Euro Stoxx 50 dividend index. Next, overwrite this position by selling a call option on the same contract at a higher strike price, say 10%-15% above the futures price.

You will earn premium by writing the option, and if the strike price is hit, you are covered because you have bought dividends and can deliver them to the option holder, earning a profit from the difference between the two prices.

The risk is that dividends fall below the futures price, further than is compensated for by the option premium.

|

Due diligence: Even skewier than equities The skew factor in dividends is even greater than it is in equities. Skew is the difference in price between out of the money put options and call options. While theoretically, options of the two kinds that are equally far out of the money should be equally priced, put options tend to be more expensive in equity markets because they are more in demand. This reflects the market’s bias towards downside hedging, because most investors tend to be long, and fear crashes. That long bias is even more pronounced in dividends. This creates some cases when dividend options have very high volatility – which is both a risk and an opportunity. |

No 2. Targeted entry: Selling puts

As we have already discussed, dividends have a very appealing risk/reward ratio.

Except when they don’t.

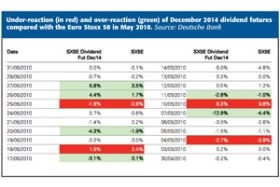

As you can see from the matrix below for May 2010, dividends can both under-react (red) and over-react to stockmarket movements. Look at the over-reaction on May 7 – Dividend Black Friday. The December 2014 contract lost 13% of its value, and the downdraft was even more pronounced in contracts at the front end of the curve.

Such sell-offs are not unusual, and they can be much steeper than in equities – contracts can fall by 50% or 60%. Nasty crashes like this occurred in both 2008 and 2010.

These exaggerated sell-offs are dangerous for traders with mark-to-market responsibilities, as they may be forced to close their trades. However, they also create buying opportunities.

Image:Under-reaction (in red) and over-reaction (green) of December 2014 dividend futures compared with the Euro Stoxx 50 in May 2010

Source: Deutsche Bank

These periodic sell-offs make the skew in dividend options even sharper. Puts become much more expensive than calls.

Taking what we know of the return to value after each crash, patient options traders might be rewarded by waiting for the right moments, and then selling put options when they are most overpriced.

If dividend expectations fall, those put options will become in the money and would probably be exercised. Thus, the investor would be entered into a long dividend futures position at a lower entry point, and therefore with greater upside. And, thanks to skew, they would receive a relatively high premium while waiting for this to happen. If the futures price recovers, the puts are unlikely to be exercised.

No 1. Pairs trading: The liquidity paradox

The Euro Stoxx dividend contract is a victim of its own success. There are equivalents in the UK, Switzerland, Germany and a somewhat active market in Japan. However, the Euro Stoxx, despite its occasionally hair-raising sector demographics – biggest sectors are banks and insurers and largest single constituent is the oil company Total – is very much the world’s index. Open interest is about €8bn in the dividend futures and €2bn in the options.

That is, paradoxically, one reason why investors sell them in times of crisis. When times are tough and you have margin calls to service there is no use trying to cash out a thinly traded S&P 500 contract – the bid-offer spread will be extreme. You’re better off trading out of the Euro Stoxx position where the quoted price will be a truer indication of your P&L.

Liquidity – a hallmark of a properly functioning market – increases the likelihood of a sell-off.

However, S&P dividend contracts currently imply 35% dividend growth over the next five years. The Euro Stoxx dividend futures are slightly backwardated, at -5%.

It’s not all down to fundamental differences between US and European dividend behaviour. In neither region can investors have visibility on what dividends companies intend to pay in 2017. Who even knows what the constituents of the indices will be in six years?

Hence, something else is puffing up S&P dividend swap values. Deutsche Bank suggests it is structural buying. “It stems from variable annuity hedging,” says Finelli. “Dealers are short put options, long-dated put options, and they need to buy the corresponding dividends in the market to cover this exposure.”

Whether you think Euro Stoxx dividends are objectively cheap or not, compared with S&P 500 dividends, they seem a good bet. A relative value trade, going long Euro Stoxx and short S&P, might be a way to capture this value discrepancy, though investors should be aware of the different structural drivers of these markets.

More than a tax dodge

These ideas demonstrate that there is more to this asset class than the tax trickery synonymous with OTC dividend swaps. There are tons of potential trades that will come to the fore as the options break into the mainstream.

Or leave aside the sophisticated trading ideas. We now live in a world where mainstream equity income funds can cheaply hedge against a disastrous fall in dividends – such as that caused by BP’s suspension of its payouts after the Macondo disaster – simply by holding some puts. You can’t help but think it’s only a matter of time before some of them do.

Despite the current dominance of futures, dividend options may one day become more liquid than the futures they are based on.

Theo Casey is a Futures and Options Intelligence columnist. He can be reached on Twitter @theocasey.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you