Opportunities aligning for emerging markets

By Kim Catechis, head of global emerging markets at Martin Currie, a Legg Mason Company

Last October, we outlined why we believed the Tide is Turning for emerging markets (EM). Since then, many of the positive drivers we highlighted have already started to become more evident. Perceptions for EM equities are now rapidly changing, with investors acknowledging the compelling opportunities of the asset class. Here, we outline why we continue to believe these are fully justified:

EARNINGS IMPROVEMENTS

The recovery in earnings among EM companies that began in 2016 looks to be quietly building momentum into 2017. Improvements in EM economic growth are now feeding through to earnings expectations, confirmed during the most recent year-end results season and backed up by an increase in the number of companies issuing positive outlook statements for the year ahead.

What’s more, this improvement is increasingly broad based. Initially concentrated in the energy and materials sectors, this has extended into areas such as industrials, consumer discretionary and financials. Can this be sustained? We believe it can, with strong economic growth, continued productivity improvements and the anticipation of looser financial conditions all positive drivers.

ECONOMIC GROWTH

Emerging markets are at the forefront of global economic growth, continuing to monopolise the highest rates of real GDP growth available (4.5% versus 1.9% for the G7 developed markets in 2017). India, for example, is expected to grow at 7.2% this year, with China projected to clock in at 6.6%; this compares with considerably more modest growth of 2.3% for the US. In fact, developing markets now account for more than 75% of global growth in output and consumption, almost double the share of just two decades ago*.

While economic growth does not necessarily translate into increases in equity valuations, it does reflect many of the strong secular trends that EM companies are benefiting from: improving demographics provide a young and increasingly well-educated growing workforce; while on the other side of the equation, a rising middle class, in particular in urban areas, will continue to propel strong consumption growth.

REFORM MEASURES

In recent years, the emergence of more progressive governments and an increasingly assertive middle class have pushed the reform agenda in many EM countries. Stronger institutions and better-functioning societies have, in turn, meant improving business environments and a greater incentive for foreign direct investment. In fact, political risk, so commonly associated with the asset class, now seems far less relevant when compared with the recent political uncertainties that have dogged many developed markets.

*International Monetary Fund. World Economic Outlook (April 2017).

LEANER COMPANIES

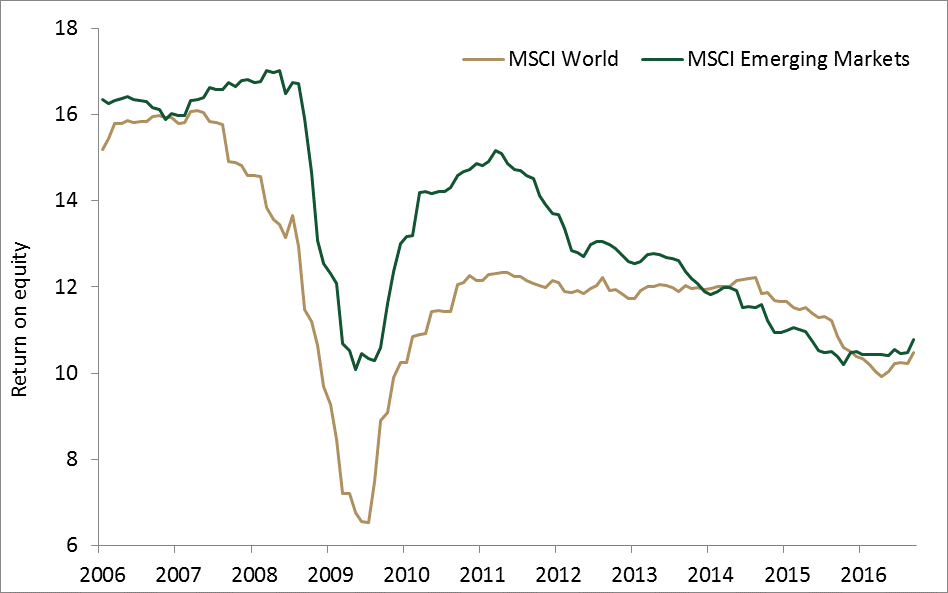

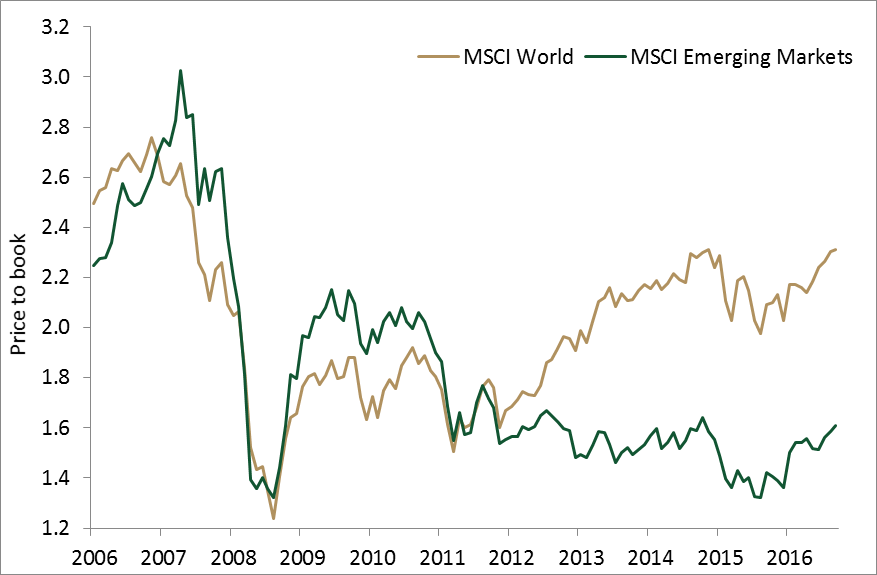

The composition of the most widely used emerging markets index – MSCI – has changed significantly over recent years, as shown in the accompanying charts. This reflects a corresponding impact on all profitability and valuation ratios for the asset class, as companies in heavily-indebted, lower Return on Equity (RoE) sectors with excess capacity have become less relevant, while those with higher RoE and stronger capital structure – the ‘new economy’ beneficiaries of the growing middle class across emerging markets – have achieved greater prominence in the index.

Graphic 1: Emerging market Return on Equity (RoE) over ten years

Source: Martin Currie. MSCI EM as at 31 May 2017.

Despite the large inflows into EM this year, the asset class still represents good value in terms of an international equity allocation. RoE is bottoming and now ahead of developed markets, as represented by the MSCI World index. Importantly though, price-to-book values remain low relative to history and developed markets.

Graphic 2: Price-to-book over ten years

Source: Martin Currie. MSCI EM as at 31 May 2017.

CONCLUSION

In a world of low growth expectations, corresponding low interest rates, and yet inexorably rising demand for returns on investment, the time is ripe for a reappraisal of the long-term opportunities that emerging markets present. We believe, now more than ever, there is a strong case for being invested in the emerging markets asset class and we remain convinced that an active approach is the best way to reap the rewards.

------------------------------------------------------------------------------------------------------------------------------------------

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice.

Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested. The document may not be distributed to third parties and is intended only for the recipient. The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

The information contained has been complied with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice. The opinions contained in this document are those of the named manager. They may not necessarily represent the views of other Martin Currie managers, strategies or funds.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you