TAIFEX: Taking Trading to the Next Level

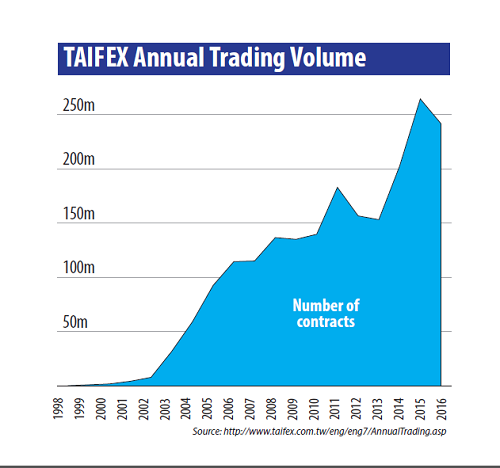

Taiwan Futures Exchange (TAIFEX) is going from strength to strength with increasing international participation and new products supporting record volumes. For the third straight year, more than 200 million contracts were traded on TAIFEX, with the total annual trading volume for 2016 reaching 241,678,556 contracts despite low volatility in the underlying market. With close to 1 million contracts trading per day, TAIFEX is well established as one of the top ten derivatives exchanges in the Asia-Pacific.

TAIFEX’s global market share of equity index contracts surged from 3.63% in 2015 to 4.18% in 2016. Foreign participation expanded from 12.02% in 2015 to 16.13% in 2016, a jump of 34% as a result of growing liquidity of core products, international cooperation and new product development.

Dr. Len-Yu Liu, Chairman of TAIFEX said: “TAIFEX is poised to extend its global reach. In a rapidly-evolving market we have the vision to be a primary derivatives exchange in Asia.”

Established in 1997, the sole futures and options market in Taiwan offers products across equities, indices, FX, interest rates and commodities. Retail investors play a vital role at TAIFEX, which constantly sees an equal level (50/50) between retail and institutional participation.

SOLID HOME BASE

TAIEX Futures (TX) and TAIEX Options (TXO), which benchmark all listed stocks on the Taiwan Stock Exchange, are among the most liquid equity index contracts in Asia. Both TX and the smaller-sized Mini-TAIEX Futures (MTX) set all-time-high volumes in 2016 and, together with TXO, accounted for over 90% of the volume at TAIFEX.

TXO has grown strongly since its launch in 2001 and has become the most heavily-traded contract at the exchange, drawing attention from local and international investors. More than 167 million contracts were traded in 2016, making it the sixth most traded equity index options product globally. TX is the most active futures product with over 34 million contracts traded during 2016, while MTX traded over 23 million.

GLOBAL OUTREACH

After introducing RMB FX futures in 2015, TAIFEX launched Taiwan’s first currency options, RMB FX options (USD/CNT and USD/CNH), which was the world’s first exchange-traded product of its kind, in June 2016. In November, it strengthened its FX product offerings with EUR/USD and USD/JPY FX futures, which traded 33,214 and 36,309 respectively by year-end, and brought new participants to the futures market.

In December 2016, it added Shenzhen SME price index ETF to its ETF futures and options product lineup, which is now composed of seven underlying ETFs linked to China’s major stock indices and one to Taiwan’s domestic index. The launch built on the international success of launching Topix futures in 2015 and Nifty 50 futures, for India exposure, in November 2016.

Dr. Liu said: “Product development plays a key role in TAIFEX’s corporate strategy. With products such as FX options, Topix and Nifty 50 futures introduced in the recent months, we are committed to providing new products to fulfil various types of investors’ needs.”

THE RISING NEWCOMERS: US FUTURES

In May 2017, licensed by the CME Group, TAIFEX introduced Taiwan dollar-denominated futures based on the S&P 500 and Dow Jones Industrial Average (DJIA) indices. Both contracts are designed to cater to the high level of demand for products linked to US-listed stocks, while also expanding asset classes, hedging channels and inter-market trading opportunities.

“Since we launched in May, market participants have shown vigorous interest in trading DJIA Futures and S&P500 Futures,” said Dr. Liu. “On a daily basis, we continue to see more trades in DJIA futures than S&P500 futures, 1,965 versus 203 in June.”

When TAIFEX launched its US futures, it initiated an after-hour trading session to 05:00 the next day, extending trading hours from 5 to 19 hours, to enable investors to manage risk outside of regular hours. In the first phase, the core products of TX, TXO and MTX as well as the FX product line and the two new US futures were listed. Within three months of launch volumes during the after-hour session were equivalent to 8.5% of the regular session and helped expand the scale of the market overall.

Dr. Liu added: “TAIFEX will continue to work ceaselessly to build a solid trading environment, while also encouraging the market’s growth and maintaining its soundness for the future.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you