Rolet: a legacy of growth

When Xavier Rolet took over the helm of the London Stock Exchange in May 2010, his inbox was unenviable for any new chief executive officer.

The previous year, shares in LSE had fallen by more than 70% touching the bottom of 404p shortly after the announcement that this relatively unknown French banker would take over from the venerable Clara Furse at the LSE.

LSE had for most of the later stage of Furse’s tenure been fighting off takeover bids and the challenge from newly launched equity trading platforms spawned by Mifid I.

Furse is remembered for the deals she didn’t do. She won plaudits for the successful blocks of hostile takeover bids, most notably from Nasdaq and Deutsche Bourse but also from others such as Macquarie Bank.

But she will always be remembered in part as the CEO who missed the opportunity to buy Liffe back in 2002, losing out to rival exchange group Euronext.

While Rolet too has a fair share of failed deals in his portfolio, the proposed mergers with Deutsche Bourse and TMX Group being the most significant, his acquisition of LCH in 2012 will define his legacy.

Despite early setbacks with both Liffe and the LME pulling out of clearing at the CCP, LCH has gone from strength to strength in over-the-counter (OTC) clearing across the globe. Revenue at LCH, which the LSE acquired for £667m, was up 26% in the most recent quarterly results and generated £447m in 2016.

It is perfectly positioned to capitalise on the open access requirements under Mifid II (despite the scepticism in some corners of the market about how feasible open access will be) and to continue to grow its OTC offerings across the world.

A decade of growth

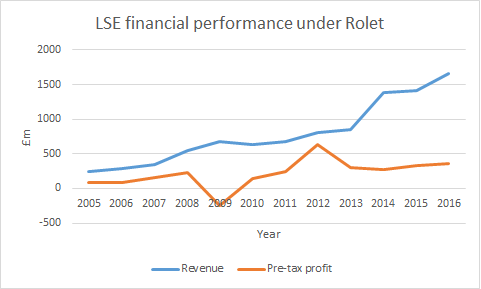

Rolet has presided over a period of unprecedented growth at the LSE.

The numbers speak for themselves.

Rolet began his tenure with the acquisitions of Turquoise and Millenium IT, the former representing a significant fight back against the Mifid-inspired multilateral trading facilities (MTFs) and the latter enabling it to sell technology to exchanges across the world.

Other notable deals during his nine-years at the helm include the purchase of the remaining stake it did not own in FTSE in 2011 and the disposal of Russell Investments in 2015.

He has maintained London’s position as the key financial market for equities listing outside New York and built a sizable bond trading business.

Derivatives

Rolet never overcame the strategic error of not buying Liffe in 2002 and he failed in numerous attempts to build organic derivatives businesses.

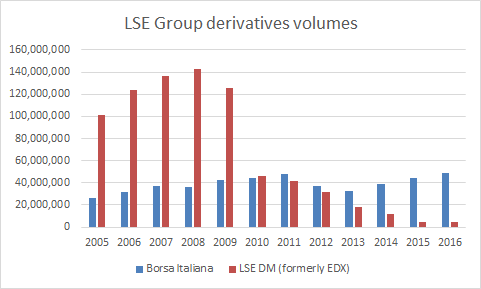

The acquisition of Borsa Italiana before he took over was a shrewd one and has paid off as the Italian market continues to grow. However, the re-branding of the EDX Market to Turquoise Derivatives in 2011 and the subsequent launch of FTSE Futures failed to gain traction.

In 2013 the LSE quietly transferred Turquoise Derivatives to the London Stock Exchange Derivatives Market in part to avoid trades on the market being treated as OTC but by then the FTSE Futures experiment had failed.

At the same time, interest in its core international order book (IOB) and esoteric Russian equity derivatives business has waned, while the partnership with Nasdaq OMX on Nordic derivatives ended in 2009. Trading volume never recovered after the LSE lost that Swedish, Finnish and Danish business.

Again, the numbers speak for themselves. Derivatives trading on the LSE’s London market has fallen from 126 m contracts in 2009 to 4.4 m contracts last year.

However, aside from the successful growth of Borsa Italiana, Rolet’s track record in derivatives represents one of the key blots in his copy book and a key challenge for his successor.

Could he have done more? The difficulties in launching derivatives platforms are ubiquitous across the market. But a "merger of equals" between the LSE and NYSE Euronext in 2012 would have made up for past mistakes and given the LSE its much needed derivatives market. Rolet was distracted by a merger with the TMX Group, which ultimately failed, during a time he should have been in discussions with NYSE Euronext.

Farewell to a true pioneer

The LSE and the City of London will miss Xavier Rolet. He has built the group into a hunter rather than the prey in the Great Game of exchange consolidation and represented the City on an international stage.

The LSE is no longer a weak takeover target but a global leader in post trade and a global equities market that may bag the Aramco prize, which Rolet has worked tirelessly to secure.

His successor will face the immediate challenge of Brexit, something that threatens Rolet’s legacy before he has even left the building, but will take over a group far more diverse and secure than the one Rolet inherited nine years previously.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you