LME and LCH.Clearnet prepare for split

The London Metal Exchange (LME) will be migrating contracts to its own clearing house in September 2014, terminating its long-standing deal with LCH.Clearnet writes Jonathan Watkins.

LME has worked with the transatlantic clearing house for the last 25 years but is now following some of Europe’s largest derivatives exchanges in establishing its own clearing platform.

Minimising disruption

Clearing competition is heating up in the European derivatives market, as exchanges look to benefit from the new wave of business resulting from regulatory reform.

LME will continue to clear through LCH.Clearnet until 22 September 2014, when the migration to LME Clear will take place.

“LME Clear and LCH.Clearnet teams have worked together to plan a controlled, efficient migration of services to the LME’s new clearing service,” said Trevor Spanner, managing director of post trade services at LME Clear.

“Ensuring continued market stability and minimising disruption for members were driving principles behind our planning.”

Migration plan

The departures of Liffe and LME coincide with the clearing business being adopted by London Stock Exchange group and the new London venue, Nasdaq OMX NLX.

LCH.Clearnet has also launched its interest rate swaps clearing service in the US and received regulatory approval to provide clearing services for the Financial and Energy Exchange (FEX) in Australia.

“LCH.Clearnet and the LME have enjoyed an excellent working relationship over the last 25 years, and have agreed a carefully negotiated migration plan to ensure a smooth transition process,” said Alberto Pravettoni, CEO of LCH.Clearnet’s repo and exchanges business.

LME Clear on FOWi

|

Big name backing

In line with the new requirements under the European Market Infrastructure Regulation (Emir), Bank of America Merrill Lynch will be securing investments with global counterparties and providing treasury execution services.

Citi will facilitate the LME Clear Secure Payment System on the new clearing platform, providing concentration bank services and processing receipts from members’ settlement banks.

JP Morgan will act as LME Clear’s gold custodian, managing member gold submitted as collateral to offset positions.

Fee increase

As the market awaited the confirmation of LME Clear’s launch date, FOWi reported that LCH.Clearnet was planning to triple the fees for the LME members to clear trades, rising from 15p per contract from 5p.

According to reports, LCH.Clearnet increased the fees due to rising capital demands on European clearinghouses.

The fees will apply to the likes of Jefferies, Deutsche Bank and Newedge.

Trading growth

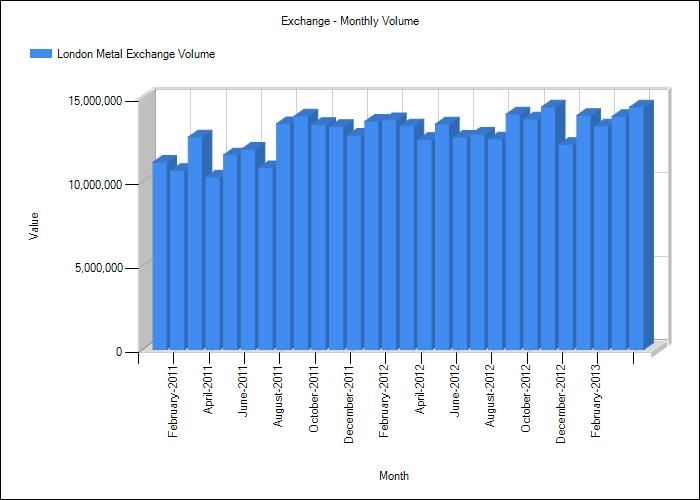

Prior to the changes in fees LME produced its second consecutive month of record volumes in May, edging past April’s all-time activity high by just under 100,000 contracts.

LME’s Q1 activity remained steady as its year-to-date volumes remained on par with 2012 but starting to rise in the past two months.

Its average daily volumes have risen 13% year-on-year to 695,130.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you