Collateral in 2017, Part 1: Challenges and opportunities for the buy-side

The new paradigm

The driving forces behind the new collateral paradigm are well known in the industry but their impact is less well understood.

The confluence of post-crisis reforms to push more over-the-counter contracts into central clearing, increase margin requirements on uncleared trades and shore-up the balance sheet of banks has significantly heightened requirements for collateral while restricting the ability of banks to intermediate in, and provide liquidity to, the market.

Since 2009, the industry has feared a “collateral squeeze” caused by a shortage of collateral to meet post crisis reforms of the financial system. These fears have been exacerbated by quantitative easing programmes by Central Banks, which have hoovered up high-quality liquid assets from the market over the past six years.

But what has emerged is less a shortage of collateral, more a clear need for better management of collateral. The view today is that there is enough collateral in the system but the optimisation, allocation and transmission of that collateral is lacking.

Inefficiencies in the system have been exposed by recent events, in particular in the repo market. As more firms and asset classes come into scope and are required to post margin at CCPs and against bilateral trades, these inefficiencies will be further exposed unless decisive actions are taken now by firms across the market.

Global Investor has conducted a detailed study of the asset management, pension fund and bank communities to understand how different firms across the market are being impacted by the new collateral paradigm and what solutions are available and being adopted to ease the pressures.

This study is based on a series of indepth interviews and an extensive survey of sellside and buyside firms. The findings of the survey are interspersed throughout this paper, supported by commentary from experts in the market.

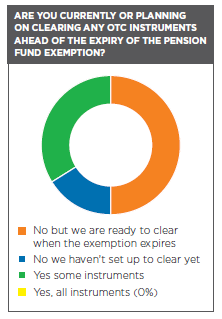

Part I explores the factors that have led to the current collateral environment and their impact on the buyside. Particular focus is paid to how the overlap of multiple strands of reforms has increased the pressure on collateral and, in some instances. negated intended regulatory exemptions.

Part II examines in depth what best practice in collateral efficiency constitutes today and outlines the steps that firms can take to reduce the overall burden, before looking at some of the wider solutions that could result in a better functioning market.

WHEN REGULATIONS COLLIDE

Two key strands of post-crisis regulatory reform have increased collateral demand for the buy-side while reducing the ability of banks to intermediate and supply liquidity to the market.

On the demand side, the clearing obligation, rules designed to force certain over-the-counter (OTC) instruments into central clearing (see Box: The Clearing Obligation), and the uncleared margin rules will ultimately raise collateral demand in Europe by hundreds of billions of Euros, according to European Central Bank estimates.

CASH IS KING: ACCEPTABLE VS ACCEPTED COLLATERAL

The biggest change for the buy-side emanating from the clearing obligation and the uncleared margin rules is a significantly increased (and for some entirely new) requirement to post collateral against daily margin calls from both central counterparties (CCPs) and bilateral counterparties.

In addition, many asset managers and pension funds operated limited futures portfolios resulting in limited involvement with daily variation margin at CCPs.

As firms are forced to clear certain OTC instruments and post margin against daily calls from their bilateral counterparties, they are faced with significant operational burdens as well as an increased requirement to hold cash.

While CCPs generally accept a variety of high quality collateral - such as government bonds, certain equities and gold - as initial margin, they only accept variation margin in cash.

Intending to provide some relief to buy-side firms having to post margin under the uncleared margin rules, BCBS/IOSCO, which was tasked by the G20 to draw up recommendations for the rules, suggested regional regulators allow a wide range of acceptable collateral to be posted as variation margin against uncleared

The list included high-quality corporate and covered bonds, equities included in major indices and gold. The BCBS/IOSCO recommendations went further stating that the list should not be viewed as being exhaustive.

This approach was mirrored in the Regulatory Technical Standards authored by the Joint Committee of the European Supervisory Authorities, which included in its rules the full list of acceptable collateral specified by BCBS/IOSO.

However, acceptable collateral is not necessarily the same as accepted collateral and the buy-side has found banks much less willing to accept non-cash collateral as variation margin against bilateral positions.

Because of the treatment of non-cash assets held on the balance sheet without title transfer under the LCR and the NSFR, banks face significantly higher costs if they accept anything other than cash as variation margin.

As a result, no respondents to the study reported their sell-side providers were broadening the types of collateral they were prepared to accept.

Indeed, many banks were reported to have used the introduction of the Uncleared Margin Rules and the subsequent need to renegotiate Credit Support Annexes to stipulate in the new agreements that cash was the only acceptable form of collateral as variation margin against bilateral trades.

A handful of larger asset managers reported that they were able to push back against cash-only CSAs but there remains a strong move towards cash-only variation margin payments.

Pension schemes were specifically granted an exemption from certain Basel III-related requirements for banks to hold capital against the risk of client default.

However, in the study, European pension funds reported two behavioral changes by banks. Firstly, there has been a gradual shift by banks towards cleared trades over non-cleared trades.

Secondly, banks have become less willing to accept high-quality government bonds as margin on non-cleared derivatives.

This has led to reports of a dramatic reduction in the number of banks willing to provide liquidity to pension funds and asset managers where those funds have a requirement or preference to post high-quality government bonds as margin, undermining the exemptions provided to pension and smaller buy-side firms by policymakers and forcing them to hold back cash against possible margin calls or explore other options to source cash.

INCREASED FREQUENCY AND RIGIDITY

The buy-side has also had to adapt to the increased frequency and settlement rigidity of margin calls under the new regime.

Numerous respondents to this study reported that the major operational challenges stemmed not just from the amount of collateral they were required to post but the volume, frequency and settlement timings of the margin calls.

Estimates of the increase in margin calls across the market range from a five to a 20 times increase for a typical buy-side entity, which places a significant operational burden on firms.

In the new world, margin calls often need to be settled on the same business day they are agreed. This means that calls must be issued, agreed and collateral to be posted selected by around 14:00 each day.

The other major operational impact stems from the requirement to post variation margin in cash.

Previously, buy-side firms were able to provide the cash desk with an exact end-of-day cash figure of what was required the next day enabling them to hold back that amount to settle margin calls and minimise idle cash.

In the past we would be fully invested in assets but now a pension fund needs to figure out how much cash to put aside as we don’t think we have sufficient repo access in times of market stress.– Pension fund manager

In the world of cash-settled, daily variation margin, firms are required to be a lot smarter about how they manage cash, running detailed analytics that predict potential cash requirements throughout the day and often being required to hold more cash back to cover any unexpected margin calls.

THE OPERATIONAL CHALLENGES FOR THE BUY-SIDE

The heaviest burden stemming from the cash requirements under the new rules falls on the shoulders of pension funds, long-only asset managers and equity funds that have historically tended not to hold large cash reserves or in some instances are mandated to be fully invested.

However, the operational burden is felt across the buy-side. All firms have had to renegotiate credit support annex (CSA) with their banks to cover the uncleared margin rules and to put in place processes to enable the calculation and collateral eligibility for variation margin against uncleared trades.

Previously clients tended to have one CSA per counterparty, which was used to trade a range of instruments and covered high-quality assets as collateral.

In the new world, clients often have a minimum of three active agreements to trade derivatives: the clearing addendum, cash-only CSAs, and CSAs covering high-quality liquid assets and cash. This is excluding the repo global master repurchase agreement (GMRA), the cash variation margin requirement and the cleared derivatives execution agreement (CDEA) required to trade OTC derivatives.

All this adds up to what one fund manager described as “an enormous additional operational requirement just to be where we were before”.

OPPORTUNITY COSTS AND INCREASED LIQUIDITY RISKS

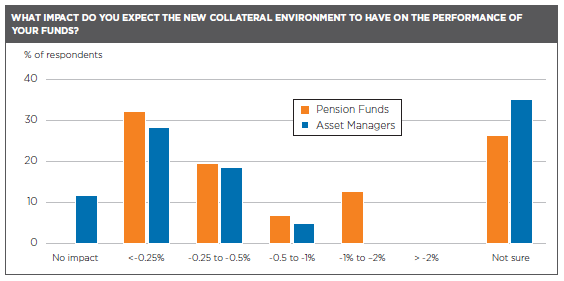

The additional cash requirements will inevitably result in a drag on performance as cash returns less than invested assets. When a fund needs to sell assets or is forced to hold additional cash, there is an opportunity cost from not being fully invested and a risk of slippage as it buys back into the position.

If a pension fund has an average return of 5% a year and it is required to hold an additional billion euros in cash because of the need to post cash variation margin, it faces a major drag on performance.

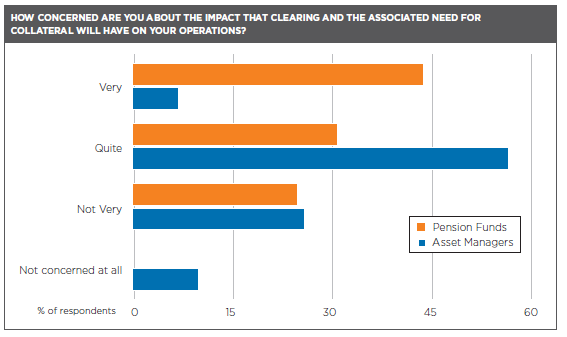

The survey revealed that pension funds expected the largest performance drag from the need to post more collateral.

Funds reported they were having, or planning, to hold an additional 3% to 6% of assets under management in cash. For a fund with €100m in assets under management, holding an additional 6% of cash would result in a reduction of returns of around representing a 0.28% drag on overall performance from the cash requirement alone.

If a fund is fully invested in equities, it may be forced to sell off some assets to generate cash to post as variation margin before buying back in to the position. That firm will need to consider the drag of holding that cash and the cost of buying back in to the position against the cost and operational risk of transformation services or using the repo market.

It may be that fund will be able to negotiate a CSA with a bank to accept high quality equities as collateral but the bank would invariably charge a fee to do that and the calculations of what an appropriate fee might be are highly complex and uncertain.

In the old world, a bank could apply a haircut against the collateral to reflect the cost of liquidating it in the event of counterparty default but owing to the balance sheet implications of accepting more in collateral as a result of the haircut, doing so would potentially increase the cost to the bank.

The biggest worry we have is that in an extreme situation at quarter or year end, we will not be able to fulfill our obligations. That terrifies us. – Pension fund manager

So the bank might look to charge a custody or administration fee to accept or transform that collateral. Any fund in such negotiations will need to have calculated the total cost it might face liquidating the assets to post cash collateral vs the opportunity cost of holding back more cash vs what the bank is asking it to pay in a fee to accept non-cash assets as collateral in order to make an informed decision on what action to take.

Some funds might need to review their mandates in order to hold more cash back to meet margin calls, an additional operation burden that will need to be factored in to the calculations.

In January 2018, variation margin will be applied to physically settled FX forwards bringing in more instruments and market participants to the new regime.

For some firms it will be the first time they have engaged in clearing and margining. Certain equity funds in particular, which use FX forwards to hedge their exposures and are fully invested, will be most impacted.

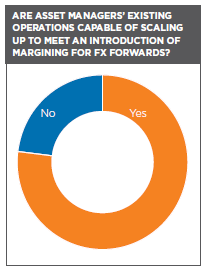

Even among those firms already engaged in posting collateral against bilateral positions and cleared OTC, many will need to invest in their operations to

Some in the market are also looking ahead to the phase-in of initial margin requirements under the uncleared margin rules which come in for most of the buy-side in 2019 and 2020.

Most expect banks to accept wider pools of collateral as initial margin mirroring the regime at CCPs. This may even lead to more flexible acceptance of collateral for variation margin.

However, it will ultimately increase further collateral demand and as such the need for effective collateral management and collateral transmission across the industry.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you