Collateral in 2017 Part 2: Effective collateral management

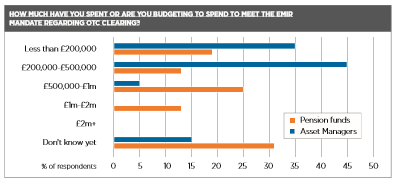

Exactly what effective collateral management constitutes is still uncertain for many across the buy-side, especially those smaller firms relatively new to dealing with margin calls and clearing trades at CCPs.

The reality is that there is no single silver bullet to solve the challenges posed by the new collateral paradigm. Indeed, taken individually, many of the initiatives may have too small an impact to merit the costs of transition for most firms.

But efficient collateral management is not just a compliance issue, it also represents a competitive edge. As costs rise elsewhere, the ability to be more efficient anywhere in the trade cycle increases margins and boosts performance.

Collateral efficiency applies across the business, across all processes and operations from trading to financing, hedging to securities lending. A wide range of collateral efficiency processes are available to firms.

They vary from reducing overall collateral requirements through netting, clearing and cross-margining positions, to buy-and-build solutions for internal operations or outsourcing collateral management to a third party in its entirety.

At an industry-wide level, various initiatives are already underway to increase the available pool and effectiveness of the transmission of collateral.

While each step may deliver only small savings or incremental increases in efficiency, the cumulative impact across the industry will ultimately lead to a more efficient and safer market for all.

Four key areas of development are analysed below: reducing collateral requirements, increasing the efficiency of internal collateral management, outsourcing collateral management to a third party and increasing the efficiency of collateral transformation and mobility through peer-to-peer offerings.

We then turn to a series of longer-term and less certain solutions.

1) Reducing collateral requirements

The most obvious way to reduce collateral pressures is to reduce the amount of collateral that will be required to post against positions. Aside from simply trading less, there are three fundamental ways to reduce collateral requirements:

- Consolidate clearing relationships

- Change what you clear and where

- Change what you trade and where

a) Consolidate clearing relationships

One of the results of the Basel III Accord and associated rules has been that most banks have implemented processes that enable a much more granular understanding of the cost each client has to their business and balance sheet across all activities.

86% of bank respondents to the survey said they had reviewed how they understand the client wallet over the past three years to factor in the balance sheet costs. While most banks’ largest clients are measured across the business, most clients will have balance costs allocated at a client or trade level with 80% of respondents measuring at a client level and 16% at individual trade level.

As a result, banks are working with their clients to help them understand how their portfolio fits in with their balance sheets.

These discussions are leading to a greater level of understanding by the client of the impact their activities have on their counterparties’ balance sheets.

Clients are able to use this insight to reduce the balance sheet impact for each of their counterparties in a variety of ways including reducing excess margin held with the bank, optimising portfolios to minimise margin requirements, participating in netting and compression cycles on a regular basis and consolidating or moving some portfolios to alternative providers.

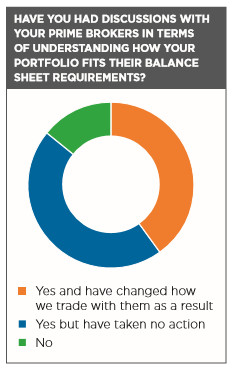

86% of the asset managers surveyed reported having discussions with their sell-side providers about their balance sheet usage and in particular an awareness of what they have been allocated and how they can use that allocation in the most efficient way. Of these, almost half changed how they trade as a result. In addition, 42% reported reducing the number of banks they trade with.

By consolidating exchange traded and over-the-counter (OTC) positions with a single bank, a client can benefit from netting offsetting positions within that portfolio. All leading banks offer some form of cross-product margining or netting programmes to their clients.

These are usually VaR-based calculations that allow for margin offsets against other products traded with the firm. In addition, some banks offer their clients the ability to cross margin OTC and futures transactions cleared at the same central counterparty (CCP) reducing cleared initial margin requirements.

Total savings and calculations vary from bank to bank and the activities of the client but require concentrating positions with a single counterparty to maximise the margin savings.

As more firms become covered by the initial margin rules for non-cleared derivatives, banks will also be able to work with clients to reduce collateral requirements with the use of synthetic swaps and other tools and methods that can decrease required initial margin under the current models.

b) Change what you clear and where

As a simple rule of thumb, the more positions that can be cleared, the lower the collateral requirements for those trades will be. This stems from both the

According to a study by the consultancy firm Deloitte, Clearing Members face capital charges of €3 per € 1m notional for an OTC cleared traded against € 120 per €1m of notional against non-cleared OTC exposures, enabling them to offer dramatically different pricing to clients able to clear trades.

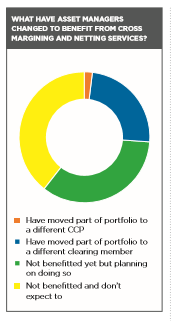

CCPs also offer cross margining services between OTC and exchange traded derivatives (ETD) contracts that enable margin savings for correlated positions.

One challenge to realising this potential though is that the current market structure in Europe requires a significant shift in open interest to realise the full potential of margin savings that the theoretical cross-margining models would enable.

Currently LCH SwapClear holds almost all of the open interest in the interest rate swaps market in both Sterling and Dollars and to a lesser extent Euros. However, following the move by ICE to shift the former Liffe ETD positions to ICE Clear Europe, LCH clears a very low market share of the exchange traded rates market.

Eurex Clearing and ICE Clear Europe meanwhile have monopoly positions in the exchange traded rates market but significantly lower levels of interest

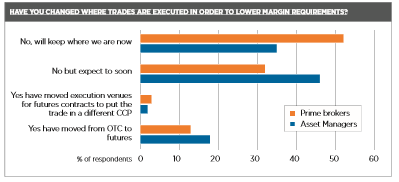

A number of respondents to the survey reported that they were either moving positions or considering moving positions in order to become more efficient in their margin requirements but scale remained a problem for smaller asset managers with volumes not large enough to justify engagement with to two CCPs.

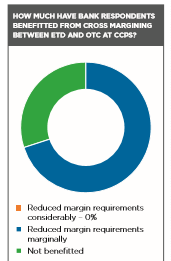

There remains significant scepticism in the market about how much can be saved without significant changes in market structure with no Prime Brokers reporting significant savings from cross margining at CCPs and 23% reporting no benefits at all.

Even for some of the larger managers, the margin savings at an individual firm or even individual fund level are not sufficient to merit moving positions over to a new CCP.

Added to that is the risk that margin savings can be eroded by increased costs of trading resulting from preferential pricing being offered by banks to trade in their preferred CCP (as was seen with the emergence of the basis between LCH and CME Clearing in the US).

Another consideration is the choice of account segregation favoured by the client. There are numerous models on offer across EU CCPs but the basic choice is between omnibus and segregated accounts. Under the omnibus model offsetting positions of multiple clients can be pooled to determine the total margin requirements.

As you move further down the road towards full segregation of assets, the ability to pool positions and therefore reduce margin requirements through portfolio margining reduces significantly.

c) Change what you trade and where

As with clearing, the more that can be traded on exchange as futures rather than OTC, the lower the collateral requirements against those positions will be.

Some firms therefore are using futures contracts to achieve exposures that would traditionally have been managed in the OTC markets.

However, standard futures contracts lack the specificity of the OTC market and provide inexact maturity dates and trade sizes to meet the demands of many participants.

For this reason, exchanges have sought to launch futurised versions of OTC contracts.

ICE transferred all of its OTC energy contracts into futures contracts in 2012. However, this was relatively simple in operational complexity owing to the identical contract structure of the OTC instrument and the future.

More challenging have been attempts to bring the OTC interest rate swap complex onto exchange.

Eris Exchange launched in 2010 trading a pared-back swap as a futures contract while CME launched the Deliverable Swap Futures in 2012.

There has been some volume in both products but open interest remains only a small fraction of the OTC market. Other initiatives such as LDX’s constant maturity futures have also failed to gain traction to date.

A major challenge for exchanges launching new contracts is that much of the buy-side is unable or unwilling to commit to trading a new futures contract until liquidity has reached a certain point. This creates a chicken-and-egg situation in which neither survive.

The challenge of launching new contracts is seen also in attempts to launch new exchanges designed to offer execution platforms that would enable lower margin requirements.

Both Nasdaq and, more recently, the London Stock Exchange have launched futures markets designed to reduce margin requirements for interest rates trading by offering trading across the long and short end of the interest rate curve in both UK and European rates.

These positions can then be further cross-margined against LCH’s swap positions (currently for sterling products and soon to be for the Euro suite).

In addition both Eurex, which dominates longer term rate futures, and ICE, which dominates the short end, have launched look-alike products on each other’s contracts to offer the same one-stop-shop for rates trading on the same platform.

Firms are able to net positions traded down the rates curve so bringing together the two ends of the curve reduces margin by up to 40% on some portfolios according to Nasdaq’s calculations.

But Nasdaq’s market closed down just three years after its launch having failed to attract enough liquidity. LSE’s new market Curve continues to grow its open interest but its market share to date remains in low single digits compared to ICE and Eurex.

Mifid II’s Open Access requirements may open up the market but with fungibility and interoperability between execution venues and CCPs not specified, a fully harmonised market structure remains some way off.

2) Increasing the efficiency of internal collateral management

This section looks at the processes and decisions involved in buying or building software to manage the collateral cycle internally.

To begin the process of reviewing collateral efficiencies, the first thing a firm will need to do is understand the volume and size of the margin calls it will be required to post and to which entities. These will depend on trading volumes and instruments traded and a view can quickly be ascertained with a discussion with your main counterparties.

A firm posting a few million euros of collateral across a limited number of positions will not find it worthwhile to invest across the whole process or bring in significant internal resources to save a few basis points on their collateral costs.

For others, the cost of inefficient collateral management will represent a significant drag on overall performance.

However, every firm will need to ensure they can source and transmit collateral to their counterparties on the same day, which will inevitably require some level of automation.

The days of managing collateral against margin calls on spreadsheets are gone for all.

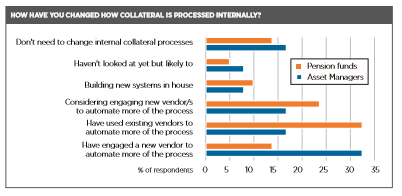

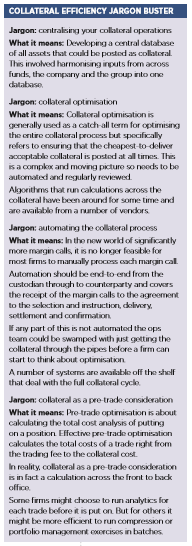

a) Centralisation

Creating a centralised view of available collateral and collateral requirements is essential to efficient collateral management. Only by gaining a single view of all margin calls and available inventory held both internally and externally can that collateral be analysed and optimised, both in terms of allocation and transmission.

A challenge for firms is that systems across a group tend to have evolved in silos with fragmented architecture. Centralising operations requires a co-ordinated effort to feed-in information on the assets held by the firm across all operations, asset classes and silos and at any custody agents used by the firm or fund.

Larger firms with higher collateral requirements might choose to create a separate business unit that controls collateral management and allocation across the group. This unit would be responsible for monitoring and allocating collateral for each position and all margin calls and collateral allocation decisions are processed through it.

A firm may need to bring in additional expertise to manage its collateral operations, a decision that will stem from the complexity of collateral management, the volume of calls the firm will be dealing with and the overall expected drag on performance that inefficient collateral operations will cause.

The consolidated view links previously fragmented pools of collateral and enables a central inventory from which the right assets can be transmitted to the right place at the right time in the most efficient way.

In addition, it allows a firm to measure how it deploys liquidity across its trading operations and enables more granular and complex risk mitigation analysis such as measuring concentration risk, wrong-way risk, market risk and stress testing.

This entails a view across derivatives, fixed income, equities and other asset classes and incorporates trading, securities lending, repo and front office operations.

Also central to inventory consolidation is identifying the location of any given asset and calculating the eligibility and cost of multiple settlement options.

To achieve this, firms need a clear, real-time view of assets held externally at different tri-party agents, central securities depositories (CDSs) and custodians as well as real-time feeds from CCPs and counterparties.

Because of the wide scope required to achieve holistic inventory management which covers the full range of processes including repo, securities finance and derivatives trading, it is essential that internal operations connect seamlessly to external software architectures.

b) Automation

Once collateral is centralised, the next step is to automate processes to receive, agree, select the assets and deliver them against the margin call.

In an ideal set-up, a margin call is received, agreed and settled with no human interaction and it is relatively straightforward to achieve this considering the wealth of off-the-shelf technology available in the market today.

The system should be able to receive the call, cross-check it against the expected call calculations made by the firm, confirm it if is the same (or within an accepted and pre-programmed tolerance of difference), select the cheapest-to-deliver collateral and then send the collateral over to the counterparty.

Only margin calls that are rejected by the system should require human interaction, the rest will be managed by straight through processing.

Automation is not a particularly complex process but it will be a new concept for many firms.

The industry standard for transmitting collateral against margin calls is the Arcadia MarginSphere network and most collateral automation software will plug into the network.

One consideration is that full automation is not simply an internal process but will including external data feeds such as those coming in and out to the custodian via Swift and visibility of the long-box held at each custodian in addition to the calls from various counterparties over the Arcadia network.

c) Optimisation of collateral selection

This requires a centralised view of collateral and a granular understanding of the cost of each asset and the implications of posting that asset as collateral.

Once a central view of all inventory is achieved, a firm can begin adopting advanced collateral optimisation techniques.

In today’s world, collateral optimisation is about far more than calculating the cheapest-to-deliver against a specific margin call.

Cheapest-to-deliver is a relatively simple calculation of the cost of posting a specific asset based on the prevailing repo rate adjusted by the haircut a specific counterparty places on that instrument.

More sophisticated algorithms are able to make that calculation in real time against multiple counterparties, which adds a layer of complexity to the calculation.

To find the absolute cheapest-to-deliver, it is necessary to run numerous scenarios across counterparties calculating not just which asset to deliver to each but the order in which each asset is allocated.

Hardest-to-please analysis ranks collateral against counterparties based on the eligibility criteria of each counterparty with the highest quality of collateral being allocated to the counterparty with the tightest criteria.

Hardest-to-place collateral identifies those assets in a portfolio that appear least often in eligibility schedules from your counterparties. This involves an algorithm running simulations to allocate the cheapest assets to deliver in a collateral pool first and then moving onto the next cheapest to deliver.

Combining hardest-to-place and hardest-to-please allocation methodology results in the largest possible volume of allocations across an inventory, reducing costs and significantly increasing collateral optimisation across all operations.

Numerous software vendors sell off-the-shelf products that run advanced algorithms across a firm’s total collateral pool to ascertain the best asset to deliver in specific circumstances.

Overall though, understanding which assets to post is a very narrow part of the solution.

The challenge is understanding how much margin activity will drag on investment performance and ensuring that a firm has the liquidity to settle the daily calls.

d) Optimising cash management

Because of the increased cash requirements in the new collateral paradigm, effective collateral management today is as much about managing cash as managing non-cash assets.

Buy-side firms need to ensure that their cash desks are in step with the terms of all the CSAs they hold with their counterparties and have embedded all expected margin calls into their daily cash requirements.

If a fund manager has 50 different funds, they will need to run the expected cash-requirements stemming from daily margin calls across each of those funds against each of their counterparties.

If any of those funds are able to post non-cash collateral under a credit service agreement (CSA) with a certain counterparty, that needs to be factored in to the calculation.

The first step is to calculate what the calls coming in that day might be as early as possible. Even if the call is coming in at 13:00, a firm can bring its data feed calculations forward to 8:00 so it has visibility on the day’s requirements early on.

A firm will need to have processes in place in which it can run simulations each day of the anticipated calls against the inventory and the counterparties to ascertain what can be covered in cash and non-cash assets.

This gives a much more accurate view of the total cash required for the day and the cash desk can be given advanced notice of the cash requirements.

3) Outsourcing collateral management to a third party

Firms without the internal resources or appetite to set up the systems required to effectively manage collateral internally can outsource the entire process to a third party collateral manager.

There are a number of leading banks that provide such a service.

Under the outsourced model the collateral management agent will have access to the clients’ long box at each custody account and manage the margin calls and collateral allocation on behalf of the client.

One reason to do this is to avoid the cost and complexity of buying and/or building the required software platforms, integrating the software across existing operations and hiring the required expertise to manage the processes.

The fully loaded costs of buying in a solution vary wildly depending on the volume of transactions and instruments traded and for many firms the calculation of whether to outsource will be a trade-off between the various costs and the day-to-day direct control they seek over operations.

But cost is not the only factor to consider. Risk management, reporting and meeting regulatory requirements are also considerations in the decision to outsource.

So too is the reliability, scalability and efficiency of operations with downtime less likely with an outsourced provider, which will also offer the ability to scale-up when required without significant upfront investment.

The advantage of an outsourced model for collateral management is operational efficiency. As it reduces the need to manage day-to-day collateral operations, firms can concentrate on their day to day activities.

4) Increasing the availability of collateral with peer-to-peer platforms

While greater collateral efficiency at a firm level will go some way to easing the pressures faced by the industry, the efficiency of collateral transformation and transmission across the market remains constrained.

Since the financial crisis, more and more buy-side firms are choosing the tri-party model to increase access to collateral. Peer-to-peer collateral platforms are the latest innovation in this area.

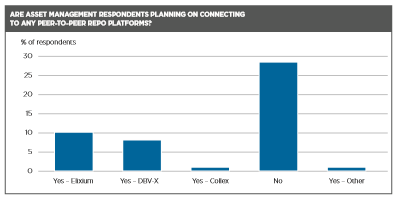

Peer-to-peer platforms such as Elixium, Collex and DBV-X, are multilateral trading facilities designed to provide an all-to-all market for the transfer of collateral.

There are numerous differences in how the three are structured but they offer a range of trading protocols including central limit order book, request-for-quote, indication-of-interest and auctions.

Respondents to the study widely welcomed the development of such platforms in theory but several barriers remain to wide-scale adoption.

Not least is the issue of liquidity. As the platforms are in their infancy there is not yet sufficient activity to attract more participants resulting in the chicken-and-egg scenario seen with new futures contracts and exchanges.

A number of respondents to the study indicated that they would connect to two or more platforms so as to ensure they back whichever emerges as the dominant venue in what most expect to be a winner-takes-all market.

Another issue is the bespoke nature of collateral. Considering the vast array of assets that constitute collateral and specificity of acceptance criteria at counterparties, collateral would have to be segmented into baskets and asset types on the platforms further increasing the need for liquidity.

Some respondents also voiced concerns as to whether the model was scaleable and whether it was feasible to accommodate the expansion in counterparties that a fully-functioning peer-to-peer market would result in.

Most buy-side firms are not able to perform credit risk management and counterparty due diligence with multiple non-bank institutions. Some platforms are seeking to address this by providing standard agreements and credit checking and certifying participants on their platforms.

The benefits of the peer-to-peer platforms taking off are clear though and once the initial concerns are addressed, they could become an important tool in the future of collateral management providing a valuable addition to the repo market.

One respondent to the study said that they see the platforms not as replacing bank participation in the market but as providing another potential source of liquidity to source collateral.

5) Longer term, longer odds solutions

Aside from the various internal and intra-industry initiatives that are outlined above there are a number of broader solutions that could in time ease the pressures faced by the industry in the new collateral paradigm.

a) Regulatory change

It was clearly not the intention of regulators to create a situation in which pension funds are facing lower returns to comply with rules designed to reduce risk taking and systemic risk at banks.

A loosening of the capital rules on banks would go a long way to solving many of the challenges enabling them to provide liquidity and collateral transformation and commit more balance sheet to providing clearing services to clients.

A number of proposals are in play for this.

The most straightforward would be to exempt high quality liquid assets (HQLA) from the leverage ratio meaning that banks can increase liquidity provision without being penalised on their balance sheets.

This would mean that banks are more willing to take HQLA as margin and significantly ease the burden for pension funds and fully invested asset managers.

Other proposals are more radical and include Trumpian promises to roll back Dodd-Frank in the US and proposals for a post-Brexit bonfire of regulations in the City of London.

However, such moves would be regressive in terms of financial stability.

Responsible, targeted and well-co-ordinated changes to current rules to reduce the unintended consequences of the confluence of post-crisis reforms are possible however and, with the right political will, achievable without negating the initial post-crisis goals.

b) Central banks backstop

A number of pension funds that took part in the study called for access to central bank liquidity during extreme market events.

They argue that they are being unnecessarily forced to make contingency plans and set cash aside to ensure access to liquidity in a stressed market.

There is no solvency risk to a pension fund that would stem from the margin requirements but there is a huge liquidity risk.

Pension funds believe that were central banks to commit to providing them with liquidity to settle and manage margin calls during market stress that would negate the need to hold back significant cash reserves.

They rightly point out that a central bank would be forced to step in to guarantee liquidity to pension funds if they were unable to access liquidity to post margin and so setting out the terms of that liquidity in advance would enable more transparency over the process, reduce operational risk and calm nerves.

But central banks could also commit to playing a wider role in the repo market to reduce gyrations and providing a floor on negative pricing. The knowledge of this floor alone would go a long way to reducing wild swings in prices.

CCPs have also been called on to do more to provide liquidity to repo and collateral markets. There are a few initiatives operated by CCPs that do this but they tend to be very small-scale and not widely publicised.

c) Create industry utilities

The creation of industry utilities to manage collateral has been touted in a number of markets. Most notably, a number of leading Dutch pension funds were in discussions to create a utility clearing entity that would become a direct member of CCPs.

Other initiatives to create single-purpose entities to manage risk and collateral are also being discussed.

The advantages of such a utility however are over-exaggerated.

While the costs of clearing would come down and it would be very easy for regulators to exempt a single-purpose entity serving solely local pension funds from capital rules designed to limit risky lending, pension funds do not have the expertise or in most cases, the desire, to effectively operate a bank-like entity.

Direct participation as a clearing member at a CCP is not a realistic proposal for all but the largest funds and even then the fragmentation of CCPs would mean that they were looking at establishing direct relationships with multiple CCPs, further increasing the operational burden.

d) Blockchain

The advent of the blockchain, or distributed ledger technology (DLT), could eliminate many of the issues facing the industry when it comes to collateral processing and transmission.

DLT would offer a number of immediate benefits.

Because of the level of transparency it enables, much of the need to move collateral would be eliminated. Using a shared ledger, firms could pledge collateral with full transparency to their counterparties without the need to physically move it.

One of the lessons from the collapse of Lehman Brothers was how difficult it was to identify ownership and claims on assets in a complex web of financial transactions.

In a distributed ledger this information would be instantly available and would give greater transparency over things like the rehypothication of assets creating more efficiencies.

For peer-to-peer platforms, the distributed ledger would overcome many of the concerns around credit worthiness and regulatory checks on counterparties. Information on members of a permissioned ledger would be embedded in their access, greatly simplifying the operational burden of other participants.

Conclusion: the looming threat of a collateral crunch

Collateral efficiency is longer a nice-to-have and today represents an essential component of the market. Asset managers and pension funds that do not invest in collateral efficiency will perform worse than those that do.

The good news is that as collateral management becomes mainstream, the cost and sophistication of solutions is falling. New technologies are emerging designed to solve the specific challenges that are arising and the pace of innovation at CCPs currently outstrips that of the rest of the market. But a more pressing reason for collateral efficiency exists.

Collateral inefficiencies across the market represent one of the most serious potential threats to the financial system.

It is easy to envisage a scenario in which an evaporation of liquidity in the repo markets following a financial shock results in firms unable to post margin against positions and creates a collateral crunch across the market paralysing the financial system.

In this scenario, the requirement to post collateral against exposures becomes a weakness not a strength of the financial system. This study has demonstrated that the sophistication of collateral processing across the industry is not sophisticated enough to withstand a collateral crunch.

It has shown that there is not a shortage of collateral but a lack of effective means of optimizing and transmitting collateral across the market.

There is a long way to run until the G20 mandate results in a market immune to contagion and systemic risk emanating from financial shocks.

A whole new infrastructure for transmitting collateral is required. There are a number of initiatives in progress which will require more support from across the market to succeed.

Market infrastructure too needs to change to realise the potential for collateral savings and ensure that more offsetting positions are held and margined at the same CCP and that in a collateral crunch CCPs do not become a cause of exacerbation through margin calls.

Ultimately a safer and more efficient market for collateral will prevail but it requires regulatory reform, new technology, shifts in market infrastructure and, most importantly, a deeper understanding of the costs and challenges.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you